Solana meme coins have started the month well, soaring by double digits as crypto investors bought the dip.

The total market cap of all Solana (SOL) meme coins tracked by CoinGecko rose by more than 4.5% to over $9.04 billion.

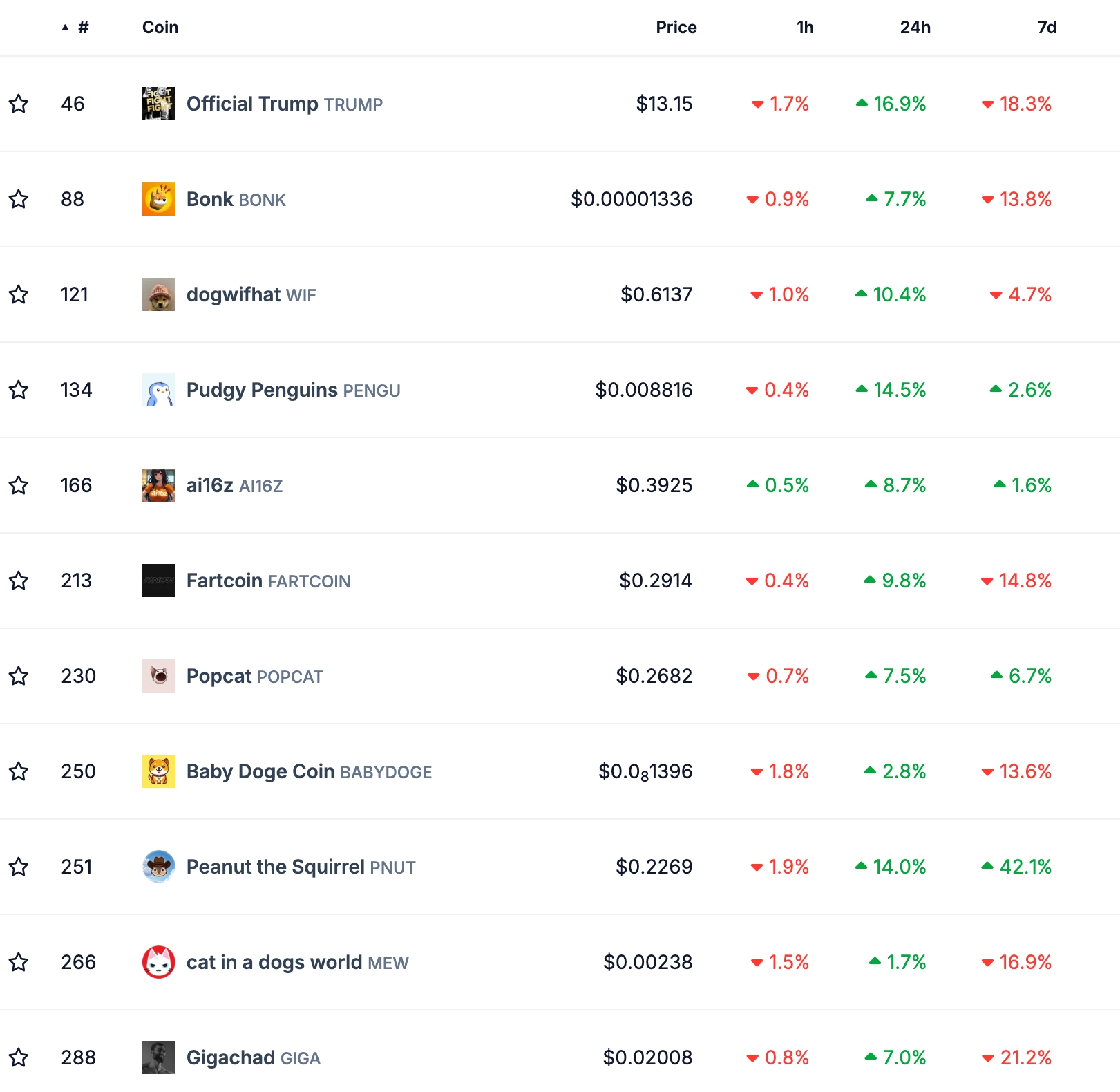

Official Trump (TRUMP) rose by 18.1%, while Dogwifhat (WIF), Pudgy Penguins (PENGU), ai16z (AI16Z), Fartcoin (FARTCOIN), and Peanut the Squirrel (PNUT) jumped by over 15% in the last 24 hours.

All of these tokens remain significantly below their all-time highs, while the market cap of all Solana meme coins is much lower than the all-time high of $25 billion.

These tokens rebounded as the crypto and stock market stabilized after this week’s crash. Bitcoin has jumped to over $85,000, while Ethereum has moved above $2,215.

Other large-cap coins rose by over 5% in the last 24 hours. Solana itself jumped by almost 10%.

Other risky assets also rebounded as investors bought the dip. The Dow Jones index surged by over 600 points, while the other blue-chip indices like the S&P 500, Nasdaq 100, and Russell 2000 also rose by over 1%.

A potential catalyst for the ongoing Solana meme coin and stocks rally is the rising optimism that the Federal Reserve will slash interest rates earlier than expected.

Odds of rate cuts rose after a series of weak economic data from the US and the upcoming tariffs on American imports.

Solana meme coins face key risks ahead

Still, these Solana meme coins have three risks. First, there is a risk that the rebound may be a dead cat bounce, or DCB — a situation where a falling asset bounces back briefly as some investors buy the dip and then resumes the downtrend.

Second, most whales and profit leaders have sold their Solana meme coins. For example, as shown below, the top 15 most profitable Dogwifhat investors have sold 100% of their holdings. The same happened among most tokens, raising concerns about rug pull scams in the Solana ecosystem.

Third, there is a risk that the ongoing fear scenario in the market may affect these tokens. The crypto fear and greed index has crashed to the fear zone of 25.

Similarly, the broader fear and greed index tracked by CNN Money has moved to the extreme fear area of 18. Risky assets like crypto and stocks lag the market when investors are fearful.

A key source of fear is that President Donald Trump pledged to impose tariffs on key allies like Canada and Mexico. Tariffs will lead to high inflation and slow growth in the U.S.