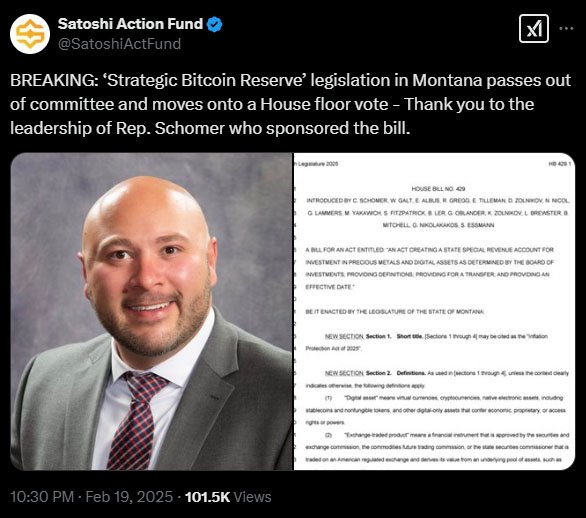

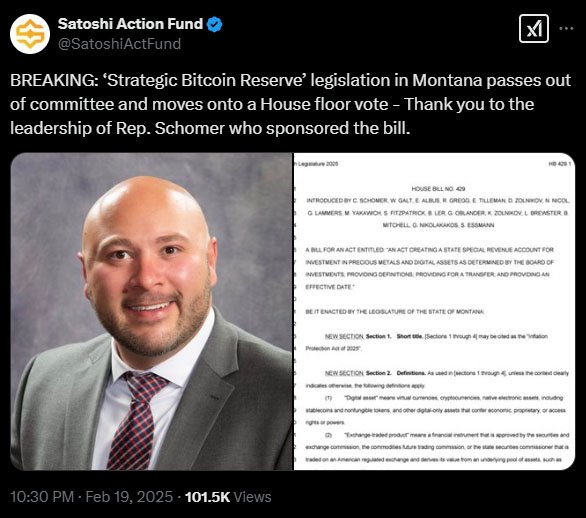

Montana is moving to allow bitcoin to be part of its state reserves. House Bill 429 (HB 429) passed the Montana House Business and Labor Committee with a 12-8 vote. All Republicans voted for it, all Democrats against.

The bill, introduced by Representative Curtis Schomer, now goes to the full Montana House. If it passes, it goes to the state Senate.

HB 429 creates a state investment fund with bitcoin, precious metals and stablecoins. Digital assets must have a market cap of at least $750 billion over the past year to qualify. Right now, only Bitcoin meets that requirement.

This bill allows Montana to invest in bitcoin as a hedge against inflation. The funds will be managed by the Montana Board of Investments, which will determine how to allocate the assets within the bill.

One big change to the bill was the removal of the requirement that digital assets have to be held by a qualified custodian or through an ETF. That has raised questions on how the state will store and secure its bitcoin.

Montana is not the only state looking at bitcoin reserves. Similar bills have been introduced in Utah, Arizona and Oklahoma which have already passed out of committee.

Illinois, Kentucky, Maryland, New Hampshire, New Mexico, North Dakota, Ohio, Pennsylvania, South Dakota and Texas, are also looking at similar measures.

Utah is leading the way, with its bitcoin reserve bill out of the House. Dennis Porter, CEO of the Satoshi Action Fund said Utah could be the first state to adopt bitcoin reserves due to its fast-track process.

Related: Utah Poised to Be First US State with a Bitcoin Reserve

Porter said more states are recognizing bitcoin as a legitimate financial asset as the initiative gains “political momentum.”

Supporters of HB 429 say adding bitcoin to Montana’s reserves will provide long term financial benefits and protect the state’s funds from inflation. The bill’s passing could also bring more bitcoin businesses to Montana and help the economy grow.

Critics, on the other hand, are worried about the risks of investing in bitcoin at the state level.

One of the biggest concerns is volatility—Bitcoin’s price has historically been all over the place. For example, during the 2022 “crypto winter” bitcoin lost over 70% of its value. But it has rebounded since, recording gains of over 600%.

Security is another big issue. Without strong protections, state-held bitcoin accounts could be a target for hackers. Critics point to 2016 Bitfinex hack, in which the major digital asset exchange lost over 120,000 bitcoin.

With the bill removing the requirement for qualified custodians, some experts question if Montana is ready to handle the technical challenges of holding and securing digital assets.

Some also worry about the lack of regulations around bitcoin. Although many bitcoin advocates say bitcoin currently enjoys the most regulatory clarity in the United States compared to other digital assets.

Beyond financial risks, some believe state bitcoin reserves could be a sign of how governments view digital assets. If Montana and other states start holding bitcoin, it could challenge the US dollar’s reign as the primary reserve currency.

Although many argue that the US dollar’s superiority as a reserve asset has long faded, pointing to rampant inflation that has been eating away at the value of the dollar reserves.

At the same time, others think integrating bitcoin into state finances could make the US economy more adaptable to the growing presence of digital assets. Bitcoin could work alongside the dollar rather than replace it.

Now Montana’s HB 429 needs to pass the full House and Senate before it reaches the governor’s desk. If the governor signs it into law, it will take effect on July 1, 2025, giving the state treasurer the right to put up to $50 million into this special fund.