Key takeaways:

|

What is pay by bank?

Pay by bank is a secure payment method that allows direct bank transfers between individuals and/or businesses. It is also referred to as electronic bank transfers or EFT because the exchange of funds is done electronically between the sender’s and recipient’s banks.

In the early days, pay by bank was commonly known as bank-to-bank, account-to-account (A2A), or direct bank transfer, as this payment method was used primarily for money transfers between two individuals. Eventually, pay by bank became a staple for B2Bs because it allows for clear paper trails. Consumers have also begun using electronic checks instead of the paper version to pay their bills.

Today, the pay by bank method includes a modern C2B approach where customers pay merchants directly through online banking and mobile banking apps.

Types of pay-by-bank methods

Pay by bank includes everything from traditional ACH transactions to digital banking apps. Each option differs in processing speed and fees.

- Wire transfers: Simple bank-to-bank processes used for large-value transfers; best for one-time transactions.

- ATM payments: Bank transfers initiated from an ATM machine; best for one-time transactions

- IVR payments: Bank transfers conducted via a computerized transaction from a pay-by-phone or Interactive Voice Response (IVR) system; best for large, one-time transactions

- Debit card payments: Transactions completed by paying with a debit card to access the source of funds; best for small, frequent payments

- Digital wallet payments: Payments made by choosing a bank account that is linked to the digital wallet in order to complete transactions; best for small, frequent payments

- Local bank-to-bank or Global ACH: Bank transfers involving accounts that are located in the same country or region. Global ACH is possible if you have an account with a foreign bank that has a presence in your region or country. Best for small, occasional payments.

- ACH payments: Transfers that go through the ACH payment network. Exclusive to US banks.

- Direct deposit: Sender completes the transaction; used for employee paychecks, taxes, and echecks

- Direct payment: Both sender and receiver initiate and complete transactions

- ACH debit: For subscriptions/recurring payments

- ACH credit: Such as Zelle and Venmo

|

In the US, the Automated Clearing House (ACH) network is composed of financial organization representatives that assume the role of processing, clearing, and settling all ACH and echeck payments.

|

See: Best ACH Payment Processing for Businesses

How do bank payments work?

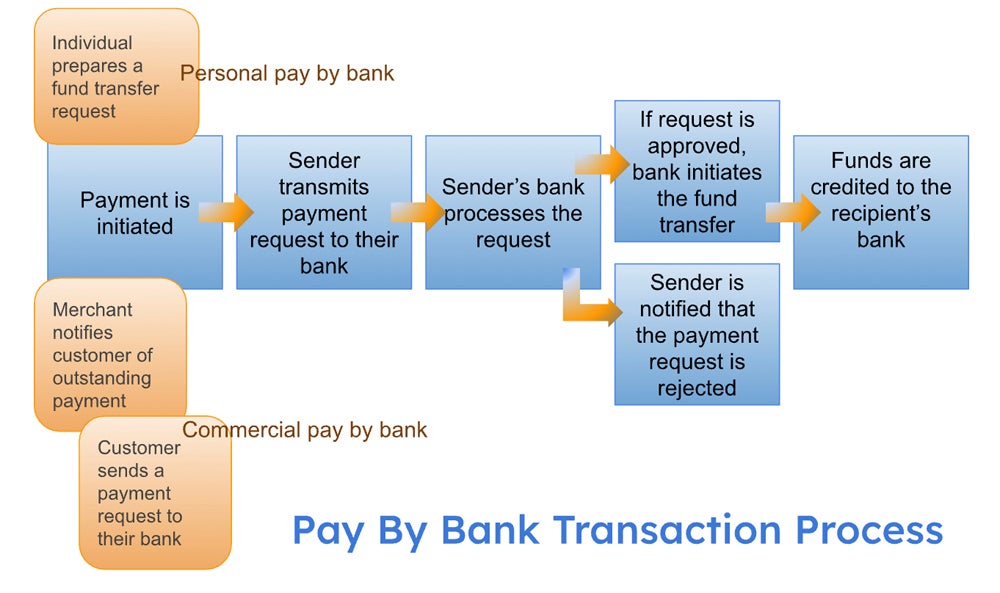

The personal pay-by-bank (individual bank transfers) process differs from commercial pay by bank (C2B, B2B) in terms of how transactions are initiated. However, the processing and clearing stages are mostly the same.

In most cases, the receiver in individual bank-to-bank transfers does not request (or initiate) the payment. Meanwhile, commercial pay by bank transactions are often characterized by payment requests, such as an invoice.

Step 1: Payment is initiated.

For personal pay by banks: The customer chooses a pay-by-bank method and prepares a fund transfer request.

For commercial pay by bank: The customer receives an invoice from the merchant, chooses a pay-by-bank method, and prepares the fund transfer request.

Step 2: Sender transmits payment request to their bank.

The sender chooses from one of the pay-by-bank types.

For IVR and ATM payment type: The sender interacts with the IVR system or ATM machine by going through the prompts to process their payment request.

For debit card payment type: The sender verifies the specified amount on the payment terminal and enters their PIN code on the PIN pad.

For digital wallet payment type: The sender logs into the app and follows the prompt for sending payments.

For all other pay-by-bank types: The sender fills out a form that specifies the transaction details as well as provides a notice of official authorization to complete the transaction.

Step 3: Sender’s bank receives and processes the request.

For all pay-by-bank payment types: The sender’s bank receives the payment and authorization request. The bank first verifies the identity of the account holder and then validates that the sender’s account has sufficient funds.

For ACH and echecks: Once the bank verifies and validates the financial information, the funds and the transaction details are routed electronically to Nacha’s ACH network for clearing and forwarding to the recipient’s account.

Step 4: If the request is approved, the bank initiates the fund transfer process.

The sender’s bank debits the transaction amount for approved (and cleared for ACH and echecks) payment requests. The bank adjusts the sender’s fund balance and also notifies the sender that the request is successful in the form of a receipt.

If the request is rejected, the sender is also notified and will have to choose a different payment method.

For digital wallet, IVR, debit card, and ATM payment types: The approval or rejection notice is also displayed on the terminal screen in addition to a printed or emailed receipt.

Step 5: Funds are credited to the recipient’s bank and the recipient is notified of the successful transaction.

The recipient of the funds will get a notification by email from their bank once the transfer is successful.

For debit card payments at the point of sale: Transaction records are kept and updated within the POS software.

Note that fund transfer speed varies depending on the pay-by-bank type. Digital wallet, IVR, debit card, and ATM transactions are nearly instantaneous. With wire transfers, the first send takes an average of three to five business days. Succeeding payments to the same recipient within 24 hours. Payments that go through the ACH network takes anywhere from two to three business days.

See: 10 Best Free Business Checking Accounts

2 ways of accepting modern pay-by-bank transactions

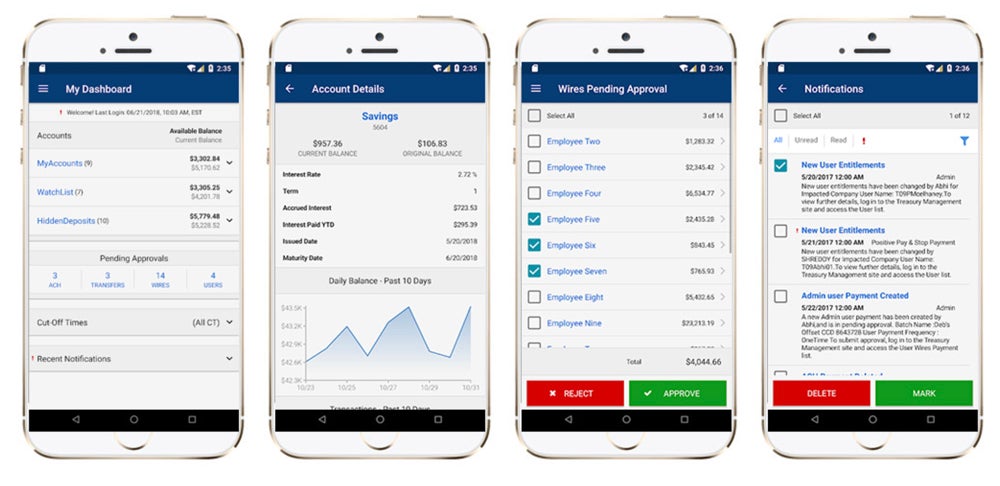

The modern pay-by-bank method is all about the use of technology in sending and receiving payments. Each pay-by-bank method, except for IVR and ATM transactions, can be done online or from a banking app.

Pay by bank online

Bank websites provide individual and business account holders with the ability to initiate transactions online. Users can log in to access their funds and a variety of features. Business bank account holders have the ability to create and send digital invoices to their customers. Those who have an e-commerce website can link their bank to their merchant account and payment processor so customers will have the option to pay via bank for their online purchase with an ACH or bank transfer.

Also read:

Pay by bank app

A banking app is a mobile wallet installed on the user’s smartphone, tablet, or iPad. It can be linked to multiple bank accounts and the available features for accepting payments will depend on the type. In both versions, the app can generate QR codes and payment links. Business bank accounts can generate invoices; individual bank accounts can even send payment requests.

5 benefits of pay by bank

Lower-risk payment method. Compared to credit card payments, pay-by-bank transactions are less risky to financial institutions since they deal with available funds instead of a credit line (such as in credit cards), resulting in lower transaction processing fees.

Accessibility. Multiple pay-by-bank types, particularly mobile banking apps, provide customers with 24/7 access to their bank accounts and faster means of payment for their purchases. This means businesses that accept pay by bank receive payments any time of the day.

Lower fees. Fees for accepting pay-by-bank payments are generally lower compared to credit card transaction fees which helps improve the bottom line for businesses.

Less prone to disputes. There are no chargeback claims in pay-by-bank transactions, which means a lower risk of incurring chargeback fees for businesses. Bank-to-bank transactions are also well documented, so senders have real-time access to records of their transactions.

Seamless cross-border transactions. Modern pay-by-bank transactions, particularly mobile banking, provide users with access to international fund transfers. In the future, pay by bank innovations will make same-day — even instant — transfers possible.

Common problems when paying by bank

Slow processing time. At the moment, pay-by-bank methods, such as ACH and wire transfers, take at least a day to process.

Transaction limits. Most pay-by-bank methods limit the transaction value allowed within a day and within a month, making it difficult to use for large-volume businesses.

Limited integrations. Pay-by-bank methods have very limited integration capabilities. Customers will have to initiate requests directly from a banking platform while merchant payment processors only support ACH and pay-by-bank app integrations.

See: 8 Best Banks for Ecommerce

Pay by bank future trends

Recent developments in the financial technology landscape focus largely on making payments faster and more convenient. Much focus is given to upgrading the current pay-by-bank infrastructure with digital railways and improved banking policies.

- Personalized mobile banking apps with AI.

2025 is the year of AI as more businesses, including banks and other financial institutions, race to integrate generative AI and machine learning to improve the banking experience with personalization. With AI, payment processing in banking apps will be more intuitive and account management will be more streamlined.

- New pay-by-bank method integrations within banking apps.

New payment options will be integrated as mobile banking apps evolve. This includes buy now, pay later (BNPL), cryptocurrency, and even QR code payments. The addition of these payment options will allow businesses, in particular, to make cryptocurrency checkout more mainstream with Central Bank Digital Currencies (CBDC)and expand BNPL adoption beyond retail. QR codes, now popular in the Asia Pacific region, are a popular method for fast cross-border transactions.

- Enhanced user experience will drive wider acceptance.

The development of mobile banking apps provides users with more convenience. Aside from 24/7 access to their bank accounts, advanced mobile apps will allow for a more seamless banking experience leading to increased adoption. In Discover’s 2024 Payments State of the Union study, 67% of consumers say they are open to using their digital identity in exchange for a more seamless payment process.

- New banking frameworks for seamless cross-border transactions.

As the UK leads the global community in using pay-by-bank for cross-border transactions, modern frameworks such as open banking will allow banks and payment processors to share financial data. Additionally, the November 2025 deadline for adopting the ISO 20022 standards for payment messaging means we are so much closer to making global real-time cross-border payments a reality.

- Improved security measures and compliance.

Security will remain a top priority in the future of pay by bank. Expect to see continued advancements in security measures as well as improved compliance to protect bank-to-bank transactions, particularly cross-border exchanges. Examples include biometric authentication and Europe’s revised PSD2, which outlines a guideline for strong customer authentication.